Issue 6

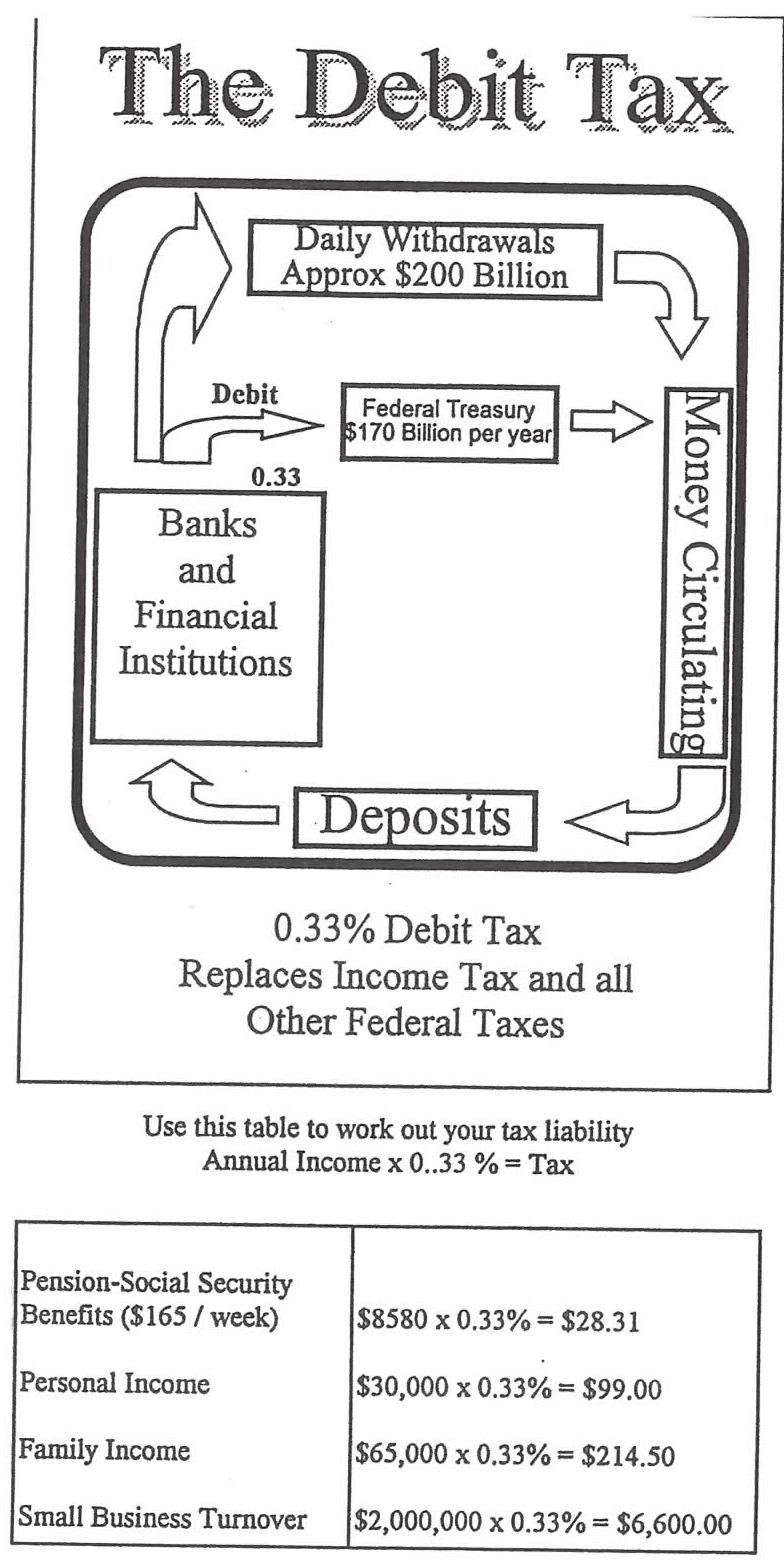

Daily Withdrawals from banks are Approx $200 Billion ( Circa 1996/7)

Money Circulating

The Federal Debit Tax formula is a simple and moderate debit tax of one third of one percent ( 0.33%) charged on all monies debited from these accounts. This tax is simply collected and forwarded through the electronic funds transfer system direct to the National Treasury. From the most recent figures released by the Reserve Bank on dollars withdrawn on a daily basis, it is estimated that for 1996/97 approximately $200 billion in withdrawals are made every working day. This would generate approximately $170 billion in Federal revenue annually more than sufficient to fund the Federal budget.

Federal Treasury spends $170 Billion per year

Banks and Financial Institutions Deposits 0.33% Debit Tax Replaces Income Tax and all Other Federal Taxes

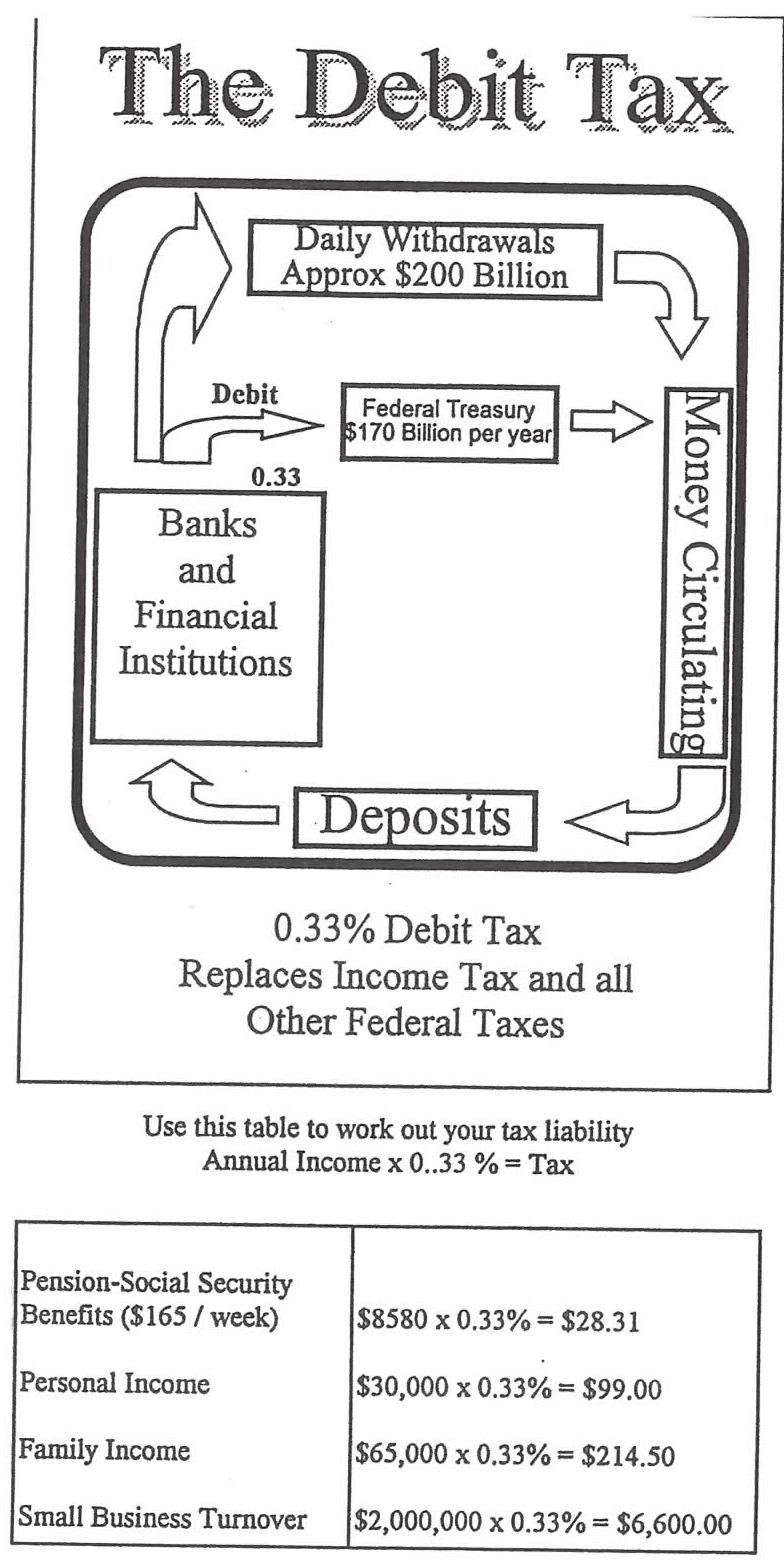

Use this table to work out your tax liability

Annual Income x 0.33 % = Tax

Pension-Social Security

Benefits ($165 /week)

$8,580 X 0.33% = $28.31

Personal Income

$30,000 x 0.33% = $99.00

Family Income

$65,000 x 0.33% = $214.50

Small Business Turnover

$2,000,000 x 0.3 3% = $6,600.00

Never doubt that a small group of thoughtful comitted citizens can change the world; indeed, it's the only thing that ever has. (Margaret Mead)

The present incumbents ( and a whole army of bureaucrats accountants and particularly tax accountants) whose income they rely on through maintaining the present system - are lying about Tax Reform

GST or Grab, Steal and Take

only means that you'll pay more

TAX REFORM IS

NO PERSONAL INCOME TAX

NO COMPANY TAX, NO EXCISE

NO OTHER FEDERAL TAXES AT ALL

EXCEPT FOR ONE

Spoken in the year 1999 Support Evolution of Taxation

With Thanks to Peter Fell and Denis Brown of Australians for Tax Reform Group / Margaret Mead and Rod

With the financial autism of Labour triumphing overall and to all the professional politicians I can only offer this advice - please listen to what is being said and ACT upon it

The only modification I would make to this is to cancel the tax on eg internet transfers between private and personal accounts eg Savings Account Homeloan Account Savings Account Current Account belonging to the same tax individual or other legal entity eg a business and maintain the tax at 1% between these different individuals and entities - and have every account registered and transparent to the Government Tax Office

In addition anyone transacting business from within Australia must hold an account in Australia. Switzerland ( and all it's Nazi Gold take note) - your days are numbered!?

Apart from Switzerland-like banking systems foreign banks would have to be lobbied and reformed just like our own

Civil rights or wrongs - it would be illegal to transact offshore for business activity entirely within Australia and all accounts transacting within Australia

Money is commonly laundered through betting shops from abroad using fixed winnings - literally - money entering the country and leaving it would not escape this - neither would multi national mining corporations, Rupert Murdoch etc

This simple tax obviates any such currently illegal transactions by making them legal and transparent to eg Centrelink

Income tax that escalates on an eg 10/20/30/40 percent sliding scale according to the tax bracket will finally remove the disincentive to work hard and be determined which every business person knows is the key to success - and the current system militates in favour of the primary motive to "go offshore" and tax avoidance and even the desire to evade would become a thing of the past - simply because of no more tax returns

The same social security not present when these taxes were first introduced ( around the time of the Napoleonic wars) who is the little chap we have to thank for the present system - not even any social reformers

the thief of Europe himself would even approve of such a simple and sophisticated tax even though 200 years have passsed since its inception

Our accountants and financial instituions could then concentrate on the job in hand of generating wealth ( and consequently taxation) rather than the time and money spent trying to avoid tax under the current system - or even evade it altogether

With apologies to LONDON and his mate CHARIVARI

Tel: 07 5499 6937

Ph: 0416 293 686

Contact Mike

* Conditions apply

Click here to go to the

home pageor press the back button on your browser